Following the correct procedures can make purchasing auto insurance online simple. The following advice will assist you in navigating the process in 2024:

Step 1: Compile Data

Get all the information you need before you begin looking for auto insurance. This comprises:

Name, address, birthdate, and driver’s license number are examples of personal information.

Details on the vehicle include the year, make, model, and VIN (Vehicle Identification Number).

Driving history: Any recent collisions, moving infractions, or insurance claims.

Step 2: Assess Your Requirements for Coverage

Choose the kind and level of coverage you require. Typical choices for coverage include:

Liability insurance: Provides coverage for harm to other parties in the event that you cause an accident.

Collision insurance: Protects your car from harm in an accident.

Comprehensive insurance: Provides coverage for losses not caused by collisions, like theft or natural disasters.

Medical costs for you and your passengers are covered by personal injury protection, or PIP.

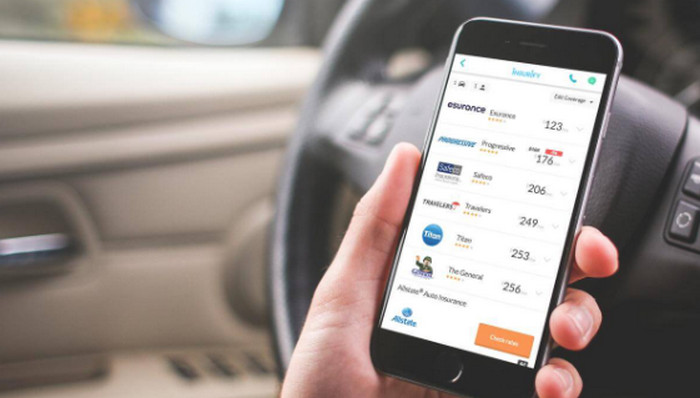

Step 3: Examine and contrast quotes

To obtain rates from several insurance companies, use online comparison tools. You may compare prices and coverage alternatives with the use of websites such as Policygenius, NerdWallet, and Insure.com.

Step 4: Look for Deals

Your premium may be reduced by the reductions that many insurance providers give. Typical savings consist of:

For drivers with a spotless driving record, there is a safe driver discount.

Discount for several policies: For combining auto insurance with additional plans, including house insurance.

Students who receive good grades are eligible for a good student discount.

Discount for low mileage: For drivers who don’t use their cars very often.

Step 5: Examine ratings and reviews

Examine the standing of the insurance providers you are thinking about. Check for consumer ratings and reviews from independent organizations such as Consumer Reports and J.D. Power.

Selecting a Policy in Step Six

After examining the alternatives and comparing rates, pick the policy that best suits your requirements and financial situation. Before making a purchase, carefully read the policy details.

Step 7: Get the Policy

Purchase the policy and fill out the online application. Payment details and any other supporting paperwork the insurer requests must be provided.

Step 8: If applicable, cancel your previous policy.

Remember to terminate your previous policy if you’re transferring insurance companies in order to avoid paying for coverage that overlaps.

Step 9: Protect Your Records

A copy of your insurance card and policy documentation should be stored in a secure location after you purchase your policy. They might be necessary while renewing your policy or in the event of an accident.

Extra Advice

Think about usage-based insurance: Certain providers provide savings based on your driving patterns, which are monitored by a gadget mounted in your vehicle.

Every year, review your policy: Reviewing your coverage annually and making any necessary revisions is a smart idea because your insurance needs may change over time.

Leave a Reply