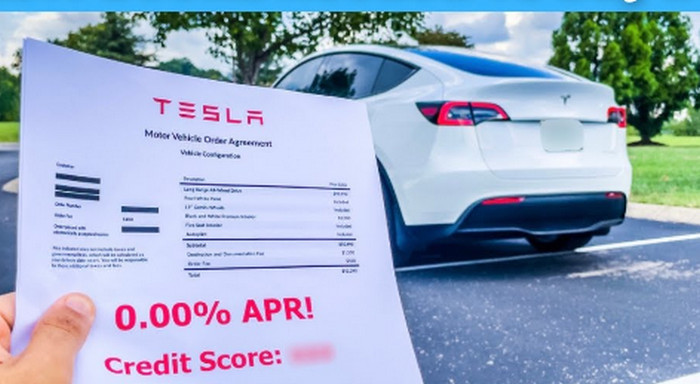

Buying an automobile is a big financial decision, and the interest rates and conditions of your auto loan are largely determined by your credit score. You can obtain better financing arrangements if you know the minimal credit score requirements and how to raise your credit. This thorough guide will assist you in navigating the procedure.

Recognizing Credit Scores

Your creditworthiness is represented numerically by your credit score, which can be anywhere between 300 and 850. They are determined by taking into account variables including credit use, payment history, credit history duration, credit kinds, and current credit inquiries1. The greater your credit score, the greater your chances of being approved for advantageous loan conditions.

Minimum Requirements for Credit Score

Conventional Vehicle Loans:

General Requirement: To be eligible for a typical auto loan, most lenders require a credit score of at least 6002. But this can change based on the lender as well as other elements like your income and debt-to-income ratio.

Good Credit: You should be able to get a car loan at a reduced interest rate if your credit score is 661 or higher.

Loans, both prime and subprime:

Prime Loans: Generally, you need a credit score of 781 or above to qualify for the greatest interest rates4. Prime loans come with better conditions and cheaper interest rates.

Subprime Loans: You could still be eligible for a subprime loan even if your credit score is below 600, but the terms and interest rates are worse2.

Programs for Special Financing:

Dealership Financing: For customers with poorer credit ratings, certain dealerships provide in-house financing solutions. Although the credit standards for these programs could be more relaxed, they frequently feature higher interest rates2.

Buy Here, Pay Here: These dealerships usually don’t demand a good credit score and finance the car purchase directly. On the other hand, interest rates can rise sharply2.

Factors Affecting the Approval of Auto Loans

Earnings and Employment

When assessing your loan application, lenders take into account your employment stability and income. A lower credit score can be somewhat compensated for by a consistent income2.

Ratio of Debt to Income:

This ratio evaluates the difference between your monthly income and debt payments. Better financial health is indicated by a lower debt-to-income ratio, which can increase your chances of loan approval2.

Requirement for Down Payment:

Even if your credit score is lower, a greater down payment lowers the loan amount and may increase your appeal to potential lenders2.

Duration of Loan:

Lower interest rates are typically associated with shorter loan durations. In the long run, choosing a shorter term can save you money if you can afford higher monthly payments2.

Increasing Your Credit Rating

Pay Your Bills On Time:

Your credit score is primarily influenced by your payment history. In order to establish a good credit history, make sure you pay all of your obligations on time1.

Lower Credit Card Amounts:

Your score can be raised by lowering your credit usage ratio, which measures how much of your credit is being used relative to your credit limit1.

Prevent Fresh Credit Requests:

Your credit score may drop a little bit with each rigorous query. Don’t apply for new credit unless absolutely required1.

Examine your credit report.

Check your credit report frequently for mistakes, and file a dispute with the credit bureaus if you find any1.

How to Get an Auto Loan Despite Having a Poor Credit Score

Obtain Prior Approval:

Obtain preapproval from a bank or credit union for an auto loan before making a trip to a dealership. This improves your negotiation position and provides you with a clear picture of your budget2.

Look Around:

To choose the best conditions, compare offers from several lenders. Never accept the first deal you are presented with2.

Think About a Co-Signer:

A dependable friend or relative with strong credit may co-sign the loan on your behalf. This may enable you to get better terms2.

Haggle Over the Price:

Negotiate the car’s purchase price rather than the amount due each month. A smaller loan and less interest paid over time are the results of a reduced buying price2.

Seek out any special initiatives.

Special financing schemes are available from certain manufacturers and dealerships for customers with less-than-perfect credit. These initiatives could offer rewards like rebates or reduced interest rates2.

Case Studies

John’s Experience

John found it difficult to obtain a conventional auto loan because of his 580 credit score. In order to lower the loan amount, he placed a greater down payment on a subprime loan, which had a higher interest rate. He made on-time payments and refinanced his loan at a lower interest rate, which helped him raise his credit score over time2.

Maria’s Approach:

Maria wanted to purchase a secondhand car and had a credit score of 620. Her credit union pre-approved her for a loan, and the terms were better than what the dealership was offering. She obtained a loan with affordable monthly payments by haggling over the car’s pricing and putting down a sizeable down payment2.

In summary

Even though having a higher credit score can help you get better conditions on an auto loan, you can still buy a car with a lower score. You may locate a loan that suits your demands and budget by learning about the minimal credit score requirements, enhancing your credit, and looking into other financing possibilities. When making a decision, don’t forget to compare prices, bargain, and take into account all the aspects that could effect the approval of your loan.

Leave a Reply